Understanding The True Value Of One Of Your Clients’

Most Valuable Assets

Traditionally, policy owners and advisors have used cash surrender value (CSV) as a benchmark of life insurance policy value. However, life insurance policy sale transactions (sometimes referred to as “viatical settlements” or “life settlements”) often allow policy owners to realize a broader market-based value for policies they either no longer want, need, or can afford to maintain.

Banks, mutual funds, and other institutional investors can diversify their investment portfolios by including life insurance policies in them. These institutions compete to purchase eligible policies in the secondary market. Thanks to market forces, including supply and demand, sellers can sell policies for much more than the cash surrender value (CSV). Often policies can sell for up to 4 times more money than the CSV on the secondary market.

How the Life Settlement Process Works

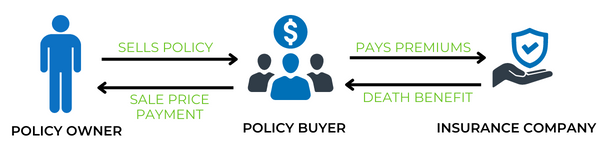

A policy owner can sell their life insurance policy to a buyer, often through the assistance of their agent or financial advisor. The agent or advisor could work with LifeRoc Capital to gain access to a global network of buyers in order to obtain offers on a variety of policy types: Convertible Term, Non-Convertible Term, Variable Universal Life, Variable Indexed Life, Second to Die, Whole Life policies and much more. The buyer pays the policy owner the agreed upon settlement amount, and then assumes the remainder of the premium payments in order to receive death benefit after the policy owner passes away.

A Summary of the Life Insurance Policy Sale Process

LifeRoc provides a detailed policy valuation upfront to determine if a policy qualifies for a life settlement and what it might sell for. If the policy qualifies, LifeRoc then assists with case design, utilizing our insurance product knowledge and life expectancy expertise to submit the policy to capable buyers in order to receive great offers. LIfeRoc assists in the closing process to expedite the change of owner and the beneficiary, and then the payment of proceeds to the client.

Do you have a client that could benefit from selling their life insurance policy policy?

LifeRoc is here to help agents successfully navigate the life settlement market, while passing on 100% of the commission to the agent.

Call our team today at (888)662-0180 to leverage our experience and gain access to our leading network of global buyers.