INVEST IN

LIFE SETTLEMENTS

No Offer or Solicitation. This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No public offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. LifeRoc does not provide investment advice.

WHAT YOU SHOULD KNOW

ABOUT THE EXCITING LIFE SETTLEMENT MARKET

“Life settlements as an asset class can provide investors with equity-like yeilds and a superior risk profile, and importantly, they are not correlated with financial markets; however, they are not risk-free.”

(Huschblackwell 2022)

LifeRoc Capital is a leading licensed life settlement provider and a top policy originator nationally in both in the secondary and tertiary markets. We review thousands of policies annually and have sourced over $20B in face amount since our founding.

LifeRoc works with asset managers who are seeking to diversify their portfolios in the exciting life settlement market. As a non-correlated asset, with realized performance tied mortality, life settlements can be a unique way to seek uncorrelated returns relative to the traditional equities and fixed income markets.

WHAT IS A LIFE SETTLEMENT & WHO QUALIFIES?

A LIFE SETTLEMENT is the sale of a life insurance policy to a third party for a one-time cash payment. The payment is more than the surrender value but less than the death benefit. The buyer becomes the policy’s beneficiary and pays all future premiums. When the policyholder dies, the buyer receives the full death benefit.

POLICY PARAMETERS

Face Amounts: $250,000.00 to $100,000,000.00

Policy Types: Universal Life Guaranteed Universal Life, Index Universal Life, Variable Life, Convertible Term, Non-Convertible Term (case by case), Whole Life (case by case)

Policy Owner Age / Life Expectancies: Ages 65+/Up to 300 Months (if the policy prices)

Policy Age: Inforce 2+ Years

Ownership Structures: Any (Trust Owned, Single Life, Second to Die, Corporate)

Needs Based: Expense Saving, Family Dynamics Change, Business Scenarios, Tax Laws

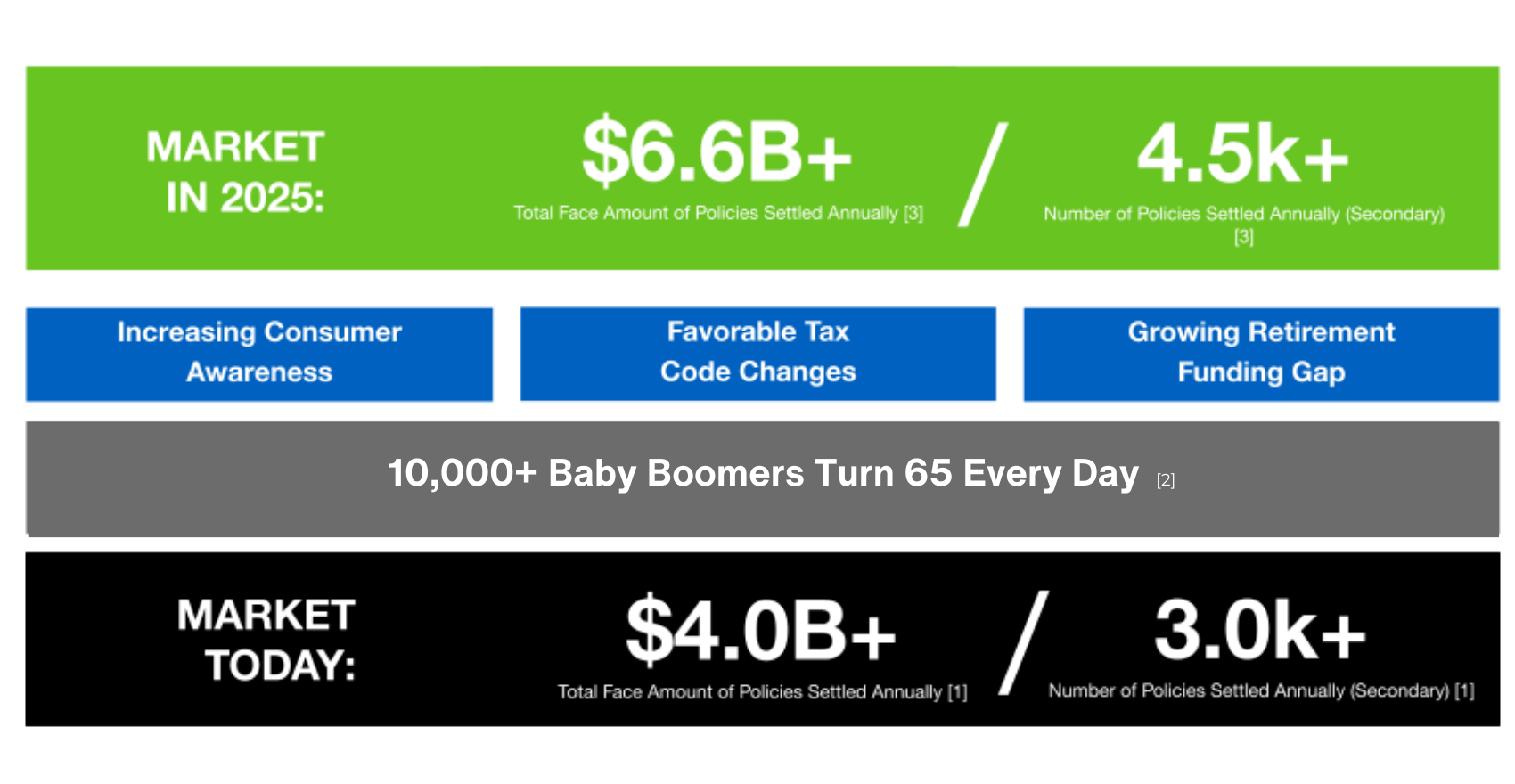

THE LIFE SETTLEMENT MARKET IS JUST GETTING STARTED

“Through our proprietary market access, premium optimization and underwriting tools, we make deploying capital in the life settlement market fast and easy for asset managers.”

LIFEROC CAPITAL

WHY INVEST IN LIFE SETTLEMENTS

Life settlements can offer differentiated returns when compared to traditional fixed-income investments. While they do carry risks, the potential for uncorrelated yield can be appealing to asset managers seeking to optimize their overall portfolio performance.

Non-Correlation to Traditional Markets

One of the primary appeals of life settlements is their lack of correlation to traditional investment markets like stocks, bonds, and real estate. This means that the performance of life settlements is generally independent of the fluctuations in these markets, making them a valuable tool for diversification.

Historical Actuarial Models

Pricing of life settlements rely on actuarial models to estimate an individual’s underlying life expectancy, which provides a framework for modeling cash flows and projecting possible investment returns. Unlike market-dependent investments, the returns on life settlements are more closely tied to actuarial predictions, mortality, and morbidity.

Yield Potential

Asset managers in life settlements are often seeking differentiated returns relative to other market opportunities. Since these returns are primarily based on the death benefit of the life insurance policies, they are considered to be less effected by economic cycles, political risk, and other macro trends.

Aging Population Demographics

As populations in many developed countries are aging, the market for life settlements is expected to grow. An increase in the number of seniors looking to liquidate their life insurance policies for financial reasons could provide a larger pool of investment opportunities.

Regulatory Advancements

The life settlement industry has seen significant regulatory improvements, enhancing transparency and consumer protections. This has made life settlements more accessible and attractive to a broader range of asset managers.

WHEN YOU WORK WITH LIFEROC CAPITAL

LifeRoc is the trusted destination for top financial professionals nationwide, and well known for integrity, transparency and our industry leading team of experts with over 200 years of combined industry experience.

Fastest Growing Top 10 Life Settlement Provider Several Years Running

The LifeRoc Team has Settled Over $20 Billion of Face Amount in our Careers Collectively

23+ Team Members and Growing with 100's of Years of Industry Experience

Policy & Portfolio Origination

LifeRoc utilizes a hybrid model to source leveraging our proprietary policy sourcing channels and open market operations to identify a diverse set of quality policies for investors’ consideration.

Pricing & Analytics

LifeRoc analyzes available policy information to calculate the minimal premium outlays to maintain a policy over the life of the asset. Our proprietary pricing system stress tests each policy and to calculate a policy’s potential economic value.

Mortality Risk Data

LifeRoc utilizes its large data set and experience to provide mortality data to assist asset managers in reviewing which medical and life expectancy profiles.

Deal Due Diligence

LifeRoc provides risk assessments on each policy to help investors ensure that each policy purchased has clean chain of title, had an insurable interest at time of issuance, is free of fraud, and is in compliance with applicable state regulations.

Active Portfolio Management

Once a portfolio is constructed, optimizing and delivery realized returns begins.

LifeRoc assists asset managers in this endeavor through regularly updating insured medical information, tracking insureds, and regularly reviewing teach portfolio for current trading opportunities.

PARTNER WITH LIFEROC ON YOUR

NEXT LIFE SETTLEMENT CASE

REQUEST A FREE 24 HOUR

POLICY VALUATION HERE

HAVE QUESTIONS?

SCHEDULE A MEETING WITH US

Schedule a Meeting with Our Team Today

General

"*" indicates required fields

Call Us

(888)662-0180

Office

12121 WILSHIRE BLVD,

SUITE 810

LOS ANGELES, CA 90025