Did you know that as a licensed advisor it may be your fiduciary responsibility to offer life settlements as an option to your clients?

A recent study showed that 90% of seniors who have let their life insurance policy lapse would have considered selling their life insurance policy if they knew life settlements were an option. The lapse not only affects the client and their beneficiaries but it also puts you, the as the fiduciary at risk, as lawsuits against advisors who have failed to show an alternative exit plan are becoming more prevalent by the day.

Take this case for example:

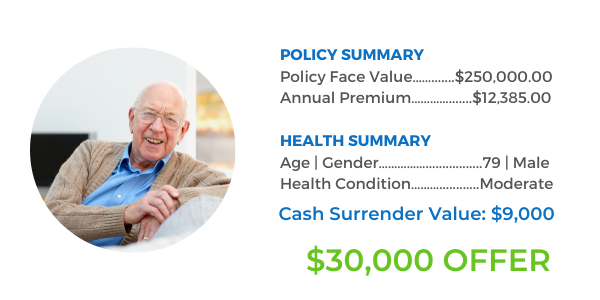

CLIENT DETAILS:

The client is a 79 year old widower who had received a notice in the mail that his $250,000 Universal Life life insurance policy was increasing in price by over $300 per month. The client was not interested in paying the increased premium, but was afraid to let his coverage go in exchange for only the cash value.

AGENT’S ACTION:

When the client reached out to the advisor, he suggested the client could reduce the policy to $100,000 and thus continue paying his original premium, or he could surrender the policy and receive $9,000 in surrender cash value.

CLIENT’S ACTION:

The client decided to get a second opinion from a different advisor, and in doing so learned that his policy may qualify for a Life Settlement. The client pursued a Life Settlement with this different agent, and received $30,000 for selling his policy, instead of only $9,000 for surrendering the policy. With this new found money the client was also able to invest $30,000 into an annuity with the new agent.

The client then fired his original insurance agent!

A recent report showed 55% of seniors have lapsed a life insurance policy. That study also showed that 79% of clients feel their advisors should inform them about the life settlements as an option. (*ICR Customer Market Research)