The Tax Cuts and Jobs Act of 2017 (TCJA) ruling resulted in more favorable tax treatment for life settlements.

The TCJA Ruling 2009-13 established that the net proceeds from a life settlement are treated as ordinary income. The net proceeds of a life settlement is determined by the cash payout you receive from the sale of a life insurance policy reduced by the premiums paid. A portion of the proceeds are taxed as ordinary income and a portion is taxed as capital gains.

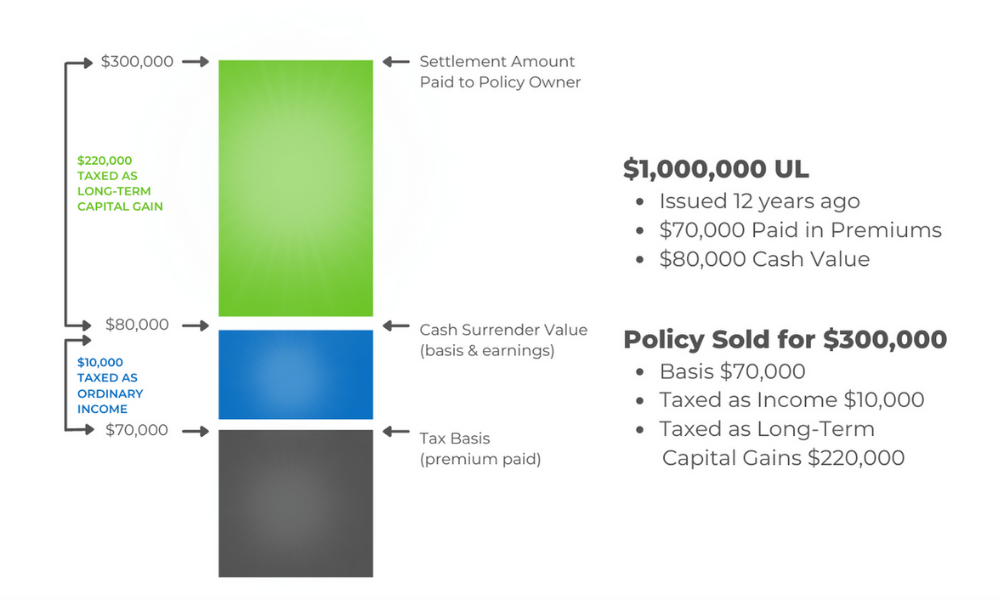

Here is a summary of how life settlement tax treatment works for policy owners who sell their life insurance.

1. Sale proceeds up to the amount of the cost basis are not taxable.

2. Sale proceeds above the cost basis and up to the policy’s cash surrender value are taxed as ordinary income.

3. Any remaining sale proceeds are taxed as long-term capital gains.

Life Settlement Taxation Case Example:

* Please consult with a tax professional. LifeRoc Capital does not offer tax advice.

LifeRoc helps agents be best in class advisors to their clients by providing great offers, direct access to our industry leading network of global buyers, while eliminating the life settlement broker commission splits!

Call us today at (888)662-0180 and save time with detailed policy appraisals and quickly learn up-front if a policy qualifies for a Life Settlement and the amount it may sell for.