3,241 people sold their life insurance policies in 2020 for a combined total of over $848 million. It’s a significant increase from the prior year despite the impact of COVID-19. (Source *Life Settlement Report, The Deal)

Thousands of Americans benefit from selling their life insurance policies every year. Many seniors that own life insurance policies can no longer afford the premiums, or their life insurance needs may have changed. A Life Settlement can provide relief by eliminating the future premium payments once the policy is sold and the immediate cash from the sale of the life insurance policy can be used for anything including; healthcare, home renovations, gifting, investment opportunities, etc.

Here are some LifeRoc success stories that demonstrate the value that life settlements can offer.

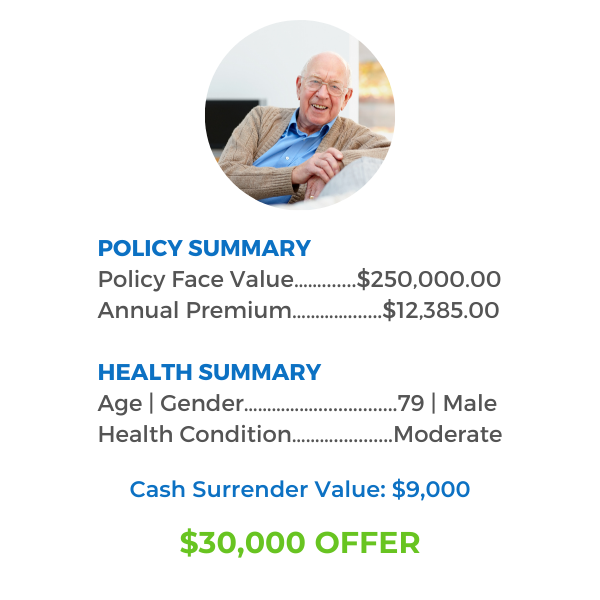

Life Settlement Success Story #1

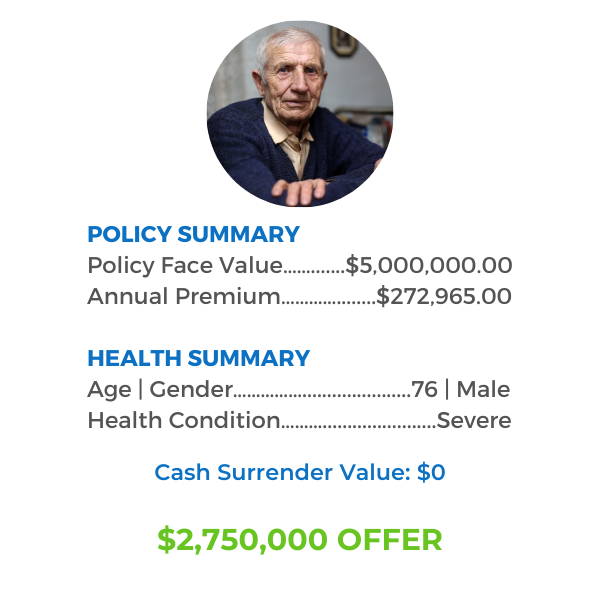

The financial advisor for this client identified better financial opportunities for his client and their family if he were to sell his large life insurance policy and receive funds to use now, rather than continuing to pay the hefty premium. The advisor reached out to LifeRoc and in doing so earned 100% of the commission and gained direct access to our large global network of buyers.

Life Settlement Success Story #2

This case example was generated when a LifeRoc advisor fulfilled their fiduciary responsibility by presenting a life settlement option to the client as a lapse alternative so that the client did not have to surrender his policy for only $9,000. Instead, the client received $30,000 for the same policy via a life settlement.