ADVISOR RESOURCES

WORK WITH LIFEROC

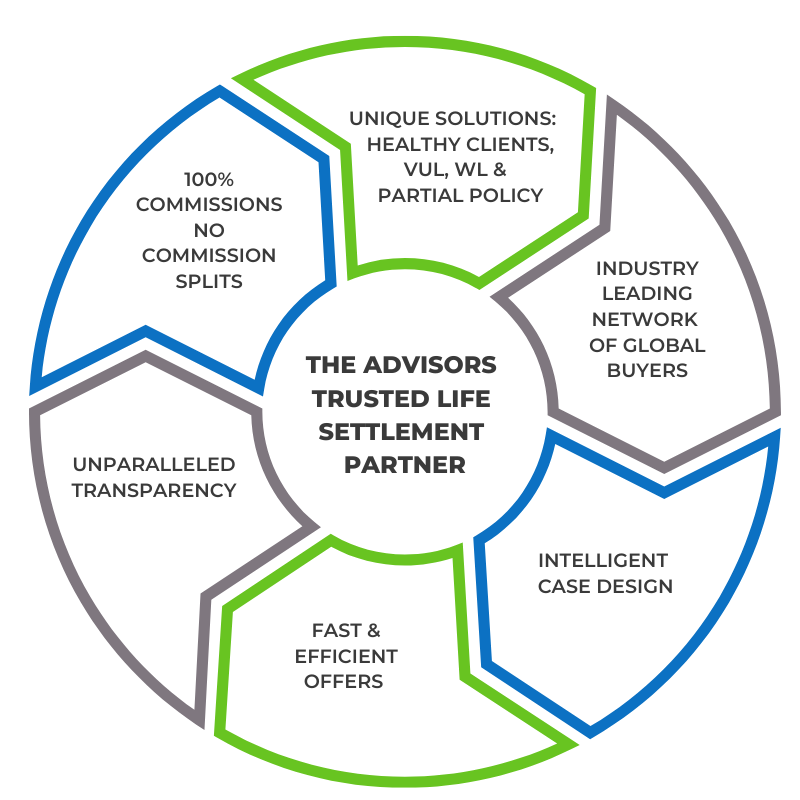

LifeRoc is here to help you and your clients navigate the life settlement process with our leading global network of funders, phenomenal deal & price execution, concierge service, and best in class case design

Fastest Growing Top 10 Life Settlement Provider Several Years Running

The LifeRoc Team has Settled Over $15 Billion of Face Amount in our Careers Collectively

On Average Advisors Make 66% More Commission with LifeRoc than with a Broker

THE LIFE SETTLEMENT PROCESS

1. OBTAIN POLICY VALUATION

Policy Valuation requests are turned around in 48 hours.

2. INITIATE UNDERWRITING

Obtaining Medical Records & LEs can take 2-6 weeks.

3. OBTAIN OFFERS

Pricing and bidding can take 2-4 weeks.

4. COMPLETE CLOSING

Closing documents and carrier changes can take 2-4 weeks.

5. SELLER IS PAID

Proceeds are released within 48 hours of carrier change confirmation.

LIFE SETTLEMENT PROGRAMS

TRADITIONAL LIFE SETTLEMENT

Directly access our leading global network of policy buyers to create value for your life settlement cases.

POLICY TYPE:

Universal Life, Convertible Term, Non- Convertible Term, Variable Universal Life, Index Universal Life, Survivorship Universal Life, and Whole Life

AGE: 60+

FACE AMOUNT: $100,000.00 +

HEALTH: 6 Months to 180 Months (Generally with 4 Tables change in health since policy issuance)

ACTION: Provide an Illustration to 105 & our Preliminary Questionnaire

REQUEST A POLICY VALUATION »

HEALTHY LIFE SETTLEMENT

With Healthy LS© you may be able to obtain settlement offers for even the healthiest insureds.

POLICY TYPE:

Universal Life, Convertible Term, Variable Universal Life, Index Universal Life, and Survivorship Universal Life

AGE: 63+

FACE AMOUNT: $500,000.00 +

HEALTH: 120 Months to 300 Months (No change in health since policy issuance required)

ACTION: Provide an Illustration to 105 & our Preliminary Questionnaire

REQUEST A POLICY VALUATION »

CASH FOR TERM

With Cash for Term™ you can obtain settlement offers for Convertible & Non-Convertible term policies.

REQUEST A POLICY VALUATION »

ACCELERATED LIFE SETTLEMENT

With Accelerate LS© you can obtain settlement offers in as little as 72 hours.

REQUEST A POLICY VALUATION »

RETAINED DEATH BENEFIT

With Retained Death Benefit you can provide solutions for those clients who still need some life insurance coverage.

REQUEST A POLICY VALUATION »

VARIABLE LIFE SETTLEMENT

With Variable CLS© you can properly transact a life settlement on the industry’s first compliant VUL life settlement platform. LifeRoc is well known as an industry leader for Variable Universal Life solutions.

REQUEST A POLICY VALUATION »

LIFE INSURANCE POLICY VALUATION

LifeRoc Policy Appraisals are quick and easy! Using our propriety pricing models we can provide an accurate pricing estimate taking into consideration real market factors and trends.

Advisors Trusted

"*" indicates required fields

By clicking "Calculate Policy Value", you agree to the Terms of Service and acknowledge receipt of our Privacy Policy.

LIFEROC CAPITAL’S LICENSING & ERRORS AND OMISSIONS RESOURCES

LIFE SETTLEMENT LICENSING

Life Settlement broker licensing requirements vary by state. In some states life insurance agents or financial advisors must obtain an additional license in order to participate in the life settlement transaction on behalf of their clients and receive commission.

LIFE SETTLEMENT E&O INSURANCE

LifeRoc offers access to several insurance companies that offers Errors and Omissions for advisors that offer life settlements.

LIFE SETTLEMENT FORMs & DOCUMENTS

NEWS: The Latest LifeRoc Capital Life Settlement Industry Articles & Resources

FREQUENTLY ASKED QUESTIONS

WHAT IS A VIATICAL / LIFE SETTLEMENT

A Viatical and/or Life Settlement is the sale of an existing life insurance policy for more than its cash surrender value but for less than the policy’s net death benefit. The industry generally uses the term “Viatical Settlement” to refer to a transaction involving a terminally or chronically ill insured and “Life Settlement” to refer to a transaction involving an insured who is not terminally or chronically ill. However, as defined in the laws and regulations of each state, these terms are not consistently used in this manner. For example, some states use the term “Viatical Settlements” to refer to any sale of a life insurance policy, regardless of whether the insured is terminally or chronically ill or not. And at least one state uses the term “Life Settlements” to mean the act of selling a life insurance policy, including ones in which the insured is terminally or chronically ill

WHAT TYPES OF INSURANCE POLICIES CAN BE SOLD?

Most types of life insurance policies and products may qualify, including Universal Life, Whole Life, Term Life, Variable Life, and Joint Survivorship.

ARE THE PROCEEDS OF A LIFE SETTLEMENTS TAXABLE?

The tax treatment of proceeds received via a life settlement will vary case by case, and as such we advise you and your clients to seek consultation from a tax professional for answers to your questions regarding taxation of life settlements.

HOW DO YOU SELL A LIFE INSURANCE POLICY?

Done right, transacting a life settlement can be quite simple:

1. The policy owner decides to sell their policy and/or entertain offers.

2. The advisor & LifeRoc work together to prepare the case for market.

3. LifeRoc accesses its large network of policy buyers to produce policy offers.

4. The policy owner accepts the most attractive offer and then completes closing documents.

5. The carrier completes the official recording of the new policy ownership and beneficiary details.

6. The policy owner receives its cash payout at time of Closing.

WHAT IS A LIFE SETTLEMENT PROVIDER?

Life Settlement Providers act as a clearing house between advisors, policy owners, and life settlement funders. Life Settlement Providers oversee the transactional documents, escrow set up, due diligence, and compliance for each life settlement. The top Life Settlement Providers work with life settlement brokers to source transactions that fit the market’s appetite which is comprised of numerous institutional funds. Life Settlement Providers must be licensed to transact policies in the state where the policy owner resides.

WHAT IS A VIATICAL LIFE SETTLEMENT PROVIDER?

Viatical Settlement Providers assist policy owners with selling their Life Insurance policies for a lump sum of cash payment now, rather than the policy owner and beneficiaries delaying cash payment based on when the insured passes away.

DOES MY STATE REGULATE VIATICAL / LIFE SETTLEMENTS?

Viatical/Life Settlements are generally regulated by each applicable state Insurance Department. Some states have enacted statutes addressing the sale of life insurance policies insuring non-terminally or chronically ill individuals, while some have laws that only regulate the sale of life insurance policies insuring terminally or chronically ill individuals, and others do not regulate the transaction at all. Most states who regulate settlements require that the Brokers and Providers each be to be licensed by the state’s department of insurance. Please contact each state directly for all specific rules and regulations.

SCHEDULE A MEETING WITH OUR TEAM TODAY TO DISCUSS YOUR NEXT LIFE SETTLEMENT CASE:

UNDERSTANDING LIFE SETTLEMENTS

Life Expectancy

Life Expectancy is an actuarial gauge for how long a particular individual is expected to live based on their age and health. Generally, the older someone is and the more health impairments he/she has, the lower their life expectancy may be.

Life Insurance Settlement Association

Founded in 1995, LISA is the most widely recognized trade association representing the Life Settlement industry, LISA participates in educational, legislative and regulatory matters in all 50 states, including Puerto Rico and Canada. Its mission is to promote the development, integrity and reputation of the life settlement industry and to promote a competitive market for its members and their clients.

Life Settlement Provider

A Life Settlement Provider purchases life insurance policies from policy owners on behalf of policy funders. Life Settlement Providers are generally licensed and regulated by each applicable state department of insurance. LifeRoc Capital is a leading direct life settlement provider.

Life Settlement Broker

A Life Settlement Broker is a person or company who represents a policy owner, and on behalf of the policy owner, identifies and negotiates sales contract terms with interested life settlement providers. Life Settlement Brokers represent their clients and generally as a fiduciary. Brokers do not represent life settlement providers of policy funders.

Life Settlement Escrow Agent

In every life settlement transaction, an Escrow Agent is hired on behalf of both the seller and buyer to establish a level of trust, ensuring all terms of the purchase agreement are met. This is typically an independent entity such as a bank, CPA or specialty escrow company, who holds and processes all documents and funds in the transaction pursuant to instructions.

Life Settlement Financing Entity

A Life Settlement Financing Entity (aka funder) is a company who is in the business of providing funds to facilitate the purchase of one or more life insurance policies and who has an agreement with a licensed Life Settlement Provider or Viatical Settlement Provider to purchase policies.

Life Settlement / Viatical Settlement License

Many states require special licensing to operate as a Life Settlement Broker, Life Settlement Provider, or Life Settlement Agent/Producer. Common requirements may include:: having a life insurance license, completion of a background check, completion of proper continuing education, and state specific reporting requirements.

Life Settlement Funder

A Life Settlement Funder is a company who is in the business of providing funds to facilitate the purchase of one or more life insurance policies and who has an agreement with a licensed Life Settlement Provider or Viatical Settlement Provider to purchase policies.

Sales Contract / Purchase Agreement

This is the written agreement entered into by the Life Settlement Provider on behalf of the policy funder, with the policy owner (Settlor/Viator) and insured. This legally binding document will detail the terms and conditions of the life settlement.

Term Conversion Life Settlements

Many term policies contain a provision allowing the term life insurance policy to be converted to a permanent product, such as Universal Life or Whole Life policy. If a tern policy can be converted to a permanent policy it increases the likelihood of the policy being eligible for a life settlement.

Verification of Coverage (VOC)

A VOC is a form of policy information documentation provided by a life insurance carrier in connection with a Life Settlement. This document is used to establish policy values, dates, and provisions for all parties to review.

LifeRoc Satisfaction Promise

If an advisor submits a case to LifeRoc the advisor is not happy with our service or our offers we will hand over the case file to the advisor so they may easily shop the policy elsewhere.

WORK WITH LIFEROC ON YOUR

NEXT LIFE SETTLEMENT CASE

REQUEST A FREE 24 HOUR

POLICY VALUATION HERE

HAVE QUESTIONS?

SCHEDULE A MEETING WITH US

How Can We Help You?

General

"*" indicates required fields

By clicking "Send Message", you agree to the Terms of Service and acknowledge receipt of our Privacy Policy.

Call Us

(888)662-0180

Office

12121 WILSHIRE BLVD,

SUITE 810

LOS ANGELES, CA 90025